What is Zander Identity Theft Protection?

According to statistics, there are 2K ID theft cases in the United States every hour. In 2017, cybercriminals stole personal data of almost 150 million American citizens. In 2022, Identity theft is a real threat, one that shouldn’t be taken carelessly even if you’re not a business owner or part of a big corporation.

If it’s user-friendly, affordable, and reliable ID restoration that you’re looking for, Zander might be exactly what you need. It will cost you $6.75 per month or $75 for a full year. If your identity is stolen, a restoration service like this one will make sure to minimize the damage. For ID monitoring slash recovery, Zander Insurance is a very good pick.

Its recovery services are comprehensive and on par with the leaders in the field. The company’s caseworkers will help you restore your credit and keep your rights reserved. Plus, they will notify the IRS and the biggest credit bureaus (TransUnion, Experian, and Equifax). It’s worth mentioning that Zander has the support and approval of numerous money-management experts. For example, Dave Ramsey has been endorsing it for more than two decades.

Sadly, Zander Insurance doesn’t provide any credit monitoring services. So, if you’re looking to check your credit score regularly and keep up with your financial records, this ID protection service won’t be a good choice. Other than that, it’s a company that you can trust to handle any ID theft cases that you might have to deal with.

In our Zander ID Theft Protection review, we’ll go over a list of pros and cons, talk about its main features, services, and more. You’ll learn about recovery benefits, wallet protection services, life insurance, alerts, and customer service. Last but not least, we’ll take a look at the available plans – Individual and Family – and see which one fits you best.

Pros and Cons

Like any other service, Zander has its strong sides and weak sides. Let’s quickly go over the list of pros and cons. We’ll discuss every single service/feature in more detail later. The following list will give you an understanding of what to expect and what Zander has to offer.

Pros:

- Unlimited recovery services

- 100% recovery success rate

- Competitively-priced plans ($6.75 per month for Individuals)

- Affordable options for families ($12.90 per month)

- Unlimited coverage for your children

- Excellent (24/7) customer service

- Personal information monitoring

- SSN, change of address, and court records monitoring

- Constant data breach updates

- Dark Web monitoring

- Stolen funds/expense reimbursement (up to $1 million)

Cons:

- Credit monitoring is not available

- Doesn’t include bank/credit account alerts

- The company doesn’t provide an app for your mobile device

Main Features & Services of Zander Insurance

With the pros and cons out of the way, it’s time for us to focus on the main features provided by Zander Insurance. This company’s coverage fully focuses on two services. Those are ID monitoring and ID theft recovery. The monitoring and alert features are quite impressive. The same can be said about the available recovery services. For example, theft insurance can reach 1 million US dollars.

Add lost wallet protection, excellent customer support, and competitive pricing, and you’ll see why this company is one of the obvious leaders in the field. Here are the most important services provided by Zander Insurance:

- ID restoration

- Life wallet protection

- Proactive monitoring

- Proactive alerts

- Stolen funds and expenses reimbursement (up to $1 million)

- Children ID protection (at no extra cost)

- 24/7 Customer service

- Protection against all known types of ID theft

Monitoring and Alerts Services

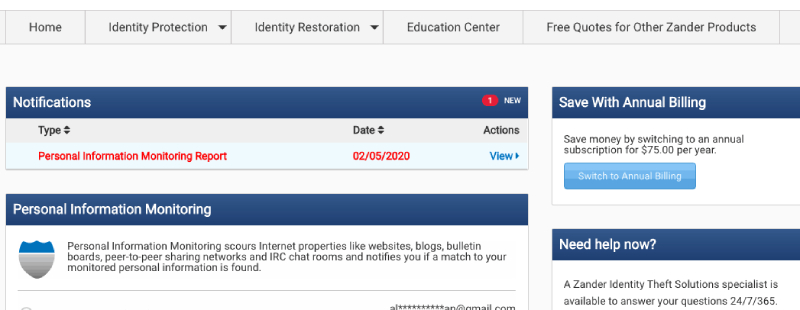

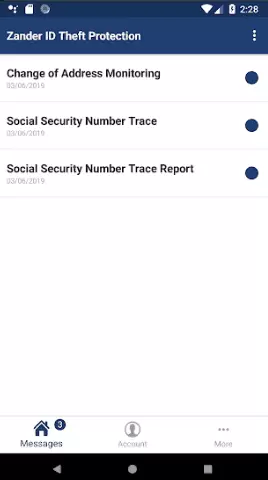

While this is a recovery-based service, you’ll still get monitoring and alerts with Zander. First of all, it includes SSN (Social Security Number) monitoring. On top of that, the company monitors court records, change-of-address, personal ID information, and more. Dark web monitoring is also a part of the deal. However, don’t expect to get a credit report from Zander Insurance: credit monitoring isn’t something it provides.

Again: credit reports or scores aren’t available regardless of the plan you end up choosing. Still, thanks to the large number of monitoring services it provides, it will most likely prevent major crimes. It’s a bit unusual to see a complete lack of credit monitoring in leading service, though.

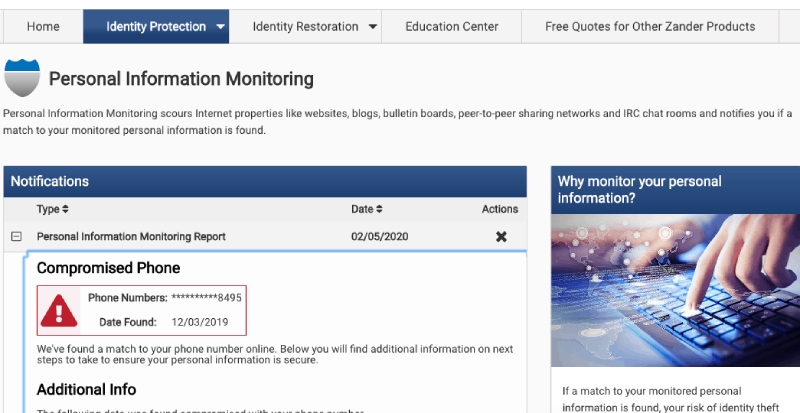

The good news is – along with Social Security Number monitoring, the company also allows the user(s) to enter extra info for control. During our review, we added more than 10 bank accounts, a passport, a driver’s license, and more. Medical ID numbers can also be added, by the way. Shortly after we created and registered our test account, Zander sent the first alert.

It turned out our email address could be compromised through some old accounts on websites we forgot about. And this was quite impressive, as not many ID insurance/monitoring companies are able to monitor suspicious activity on outdated and not-at-all popular sites. Last but not least, Zander monitors the Dark Web and informs you of any unusual activity. Social Media monitoring isn’t included.

Zander Recovery Benefits

When it comes to recovery, Zander Insurance shines brightly – it provides full-service restoration for its clients. The company likes to emphasize the “full-service” part of the deal constantly, but what does that mean in simple words? First of all, the staff at Zander will help you get in contact with issuing agencies (like your bank) and inform them of the situation you’re dealing with.

The loss of bank, credit, or membership cards qualifies as an emergency, and the sooner you take action, the better. Zander will also contact the police on your behalf and check your credit report. A Recovery Advocate will be assigned to you, and we highly recommend contacting this person in case of ID theft. They will manage your case, come up with a working recovery plan, and guide you throughout the entire process.

Here are the steps that a Recovery Advocate takes:

- Credit file restoration – it will “go back” to the pre-theft status.

- Major credit bureau notification – TransUnion, Equifax, and Experian will be notified of ID theft/fraud.

- The IRS, government agencies, and medical institutions will also be warned.

- Finally, a fraud alert will be placed.

And what about insurance – how does this company cover your losses? In the case of ID theft, the criminals can not only steal money from your bank account but also take out loans, among other things. Plus, hiring a lawyer, taking a break from work, and possibly paying for childcare can cost you a pretty penny. Thankfully, you won’t have to worry about those expenses with Zander.

As we said in the beginning, Zander repays up to one million US dollars for stolen funds (from bank accounts of credit cards), extra expenses, and everything else in between.

Lost Wallet Protection

Along with the basic alerts we mentioned above, Zander Insurance offers a couple of extra services. For example, if you lost your wallet, or if somebody stole it from you, Zander will make sure to cancel any active cards that may be abused by the thieves. Plus, they’ll help with the re-order of brand-new credit or debit cards. The list also includes health insurance, ID, and any other cards.

In some cases, it can take a while for a regular person to cancel/block their cards. Companies like Zander are capable of doing that much quicker and thus keeping your hard-earned cash from being stolen. On the official website, you’ll find a so-called “Education Center” that includes user-friendly tips on how to spot and prevent ID theft.

This is important: while this company doesn’t provide annual credit scores and reports, you can get a hold of them on your own. In The Education Center, you’ll find simple instructions on how to request these from the three major bureaus.

Life Insurance

Even though the ID protection deal doesn’t cover it, you can still get life insurance with Zander. All you’ll have to do is click “Life” on the official website – it’s located in the far left corner, next to ID. You can start a free quote right there and then without having to wait for any confirmation. There’s also an insurance calculator that can help estimate how much insurance you need.

The calculator requires personal information such as age, burial cost, debt, savings, retirement savings, annual income, and more. Once you enter all that info, the website will reveal your life insurance needs. While this isn’t an exact science, still, it might be useful to use this feature to have some understanding of what your insurance might look like.

Customer Service

Before we talk about the available packages and their respective prices, let’s check out Zander’s customer service. It is available 24/7 and is always ready to help out the clients with any questions they might have. We were impressed by how fast and effective Zander’s support agents are. It didn’t take us long to connect with support via phone.

The company also offers a clear refund policy: you can get a full refund within 14 days of purchasing any of the available plans (be it the $6.75 per month or $145 per year subscription). However, if you’ve used a recovery service, you won’t get any of your dollars back. Also, you can cancel the subscription through the official website, regardless of whether you’re on a per month or per year plan.

But we recommend getting in contact with customer service over the phone and letting them handle everything. The signing up process is very easy and straightforward – the same is true for logging into the web app. On the main dashboard, you’ll see exactly what info the Zander agents are monitoring for you. The alerts are also displayed on the main page. That’s pretty much all the information a regular user needs.

Compare Packages

|

Plan |

Individual |

Family |

|---|---|---|

| Pricing |

$6.75 per month |

$12.90 per month |

| Credit File Restoration |

+ |

+ |

| SSN Monitoring |

+ |

+ |

| Medical Record Monitoring |

+ |

+ |

| Change-of-address monitoring |

+ |

+ |

| Personal Information Monitoring |

+ |

+ |

| (Full-Service) ID Restoration |

+ |

+ |

| ID Theft Insurance ($1 Mil) |

+ |

+ |

| Stolen/Lost Wallet Recovery |

+ |

+ |

| 27/7/365 Customer Service |

+ |

+ |

| Children Protection |

– |

+ |

These are the Zander Insurance packages at a glance. Yes, the company only provides two plans to pick from, but they are more than enough for the average user. Compared to other theft protection services, Zander is significantly more affordable. Let’s take IdentityWorks (Experian), for example. With it, you’ll get an entry-level ID and credit monitoring for 9.99 USD per month. The family plan will cost you 19.99 USD per month.

IdentityForce, in turn, is more feature-packed and comprehensive. Sadly, its UltraSecure package is available for $17.95/month, while the family package costs $23.95. And while both these products include credit card monitoring, for a person only interested in personal information (ID) protection/restoration, all those extra features won’t do any good.

As a low-cost option to help people get their lives back after ID theft, Zander Identity protection is a very good choice. With affordable monthly and yearly plans and generous recovery services, it’s a can’t-go-wrong-with solution.

Individual Plan

And now, let’s take a closer look at the available plans, starting with Individual. The most important thing to know about the Zander plans is that they provide the same monitoring and protection services. The only real difference is in the number of users they cover with one subscription. If you’re a single person and only require protection for yourself, the Individual plan will suffice.

It provides monitoring services, recovery benefits, lost wallet protection, life insurance, and more. Again, these two plans are identical to each other and include all the features/services that we discussed earlier. But, with the Family Plan, you’ll get protection not for one, but multiple identities.

Zander Individual is available for $6.75 per month. The long-term plan will cost you $75 per year, meaning you’ll get to save 6 dollars in the long run. There are no other monthly or yearly subscription options available, which is a common thing among ID theft solutions. Zander’s biggest selling point is the below-average pricing.

Dave Ramsey is not a man that likes to spend big bucks on ID protection. That’s probably the main reason why he’s been endorsing this company for so long. True, there are some cheaper solutions on the market, but they can’t compare to Zander in terms of reliability.

Family Plan

An average family that includes 4-5 members should consider going for the family plan. That way, they will be able to save money. The Family plan includes protection for kids under the age of 18 – this option isn’t available with the Individual plan.

It’s worth mentioning that your children will get the full package: Social Security number monitoring, personal info monitoring, wallet protection, and reimbursement. Adult dependents will also be partially covered. Dependent adult children (up to the age of 26) will be protected as well. They are fully eligible for lost wallet protection, recovery, and reimbursement.

Zander Family costs $12.90 per month. If you need protection for a full year, you’ll have to pay $145. Like with the Individual plan, this will allow you to save a bit (~10 dollars in the case of the Family package).

Final Verdict

With the current state of things and the scope of ID theft, identity protection is a necessity. The world isn’t getting safer, and it’s vital to protect your ID, along with the identities of your loved ones. None of us have the time or expertise to do that. Therefore, we should all rely on world-respected services that will take care of everything for us.

Zander has a great value for users looking for ID theft restoration. As we learned throughout this Zander review, it’s more affordable than most similar products because it offers a limited, yet industry-leading set of services. Experian and ID Force, its closest rivals, come packed with more features and tools. At the same time, they’re significantly more expensive, while Zander is available for $6.75 per month.

So, if it’s identity theft protection that you’re interested in, there’s no point in picking the more comprehensive offers on the market. Zander doesn’t cover credit reports and lacks some advanced features, but that’s exactly why the company is keeping the price-tag so low. As for the 1 million USD reimbursement deal, it is usually found in the ultimate tiers of the most expensive brands.

With Zander, reimbursement is available not only for the individual but also for the family memberships. As a budget-friendly identity theft protector (only $12.90 per month for the entire family), this service deserves the highest praise. When it comes to preventive measures, Zander falls behind the competition. But the recovery services it provides are on par with the leaders.

Go over our review once again to make sure that you do, indeed, like what this company has to offer.