Can You Rely on Equifax?

Equifax was a credit history bureau that was established back in 1899 in the U.S. To date, the organization has grown up with offices in various countries globally. It collects information for more than 800 million individuals and more than 88 million legal entities – that is, it covers almost 11% of the world’s population.

The service also specializes in credit history and analyzes the specific situation, determining the reason for the loan requests decline. If technical errors have been made, they are corrected automatically. If the bad credit history is related to non-compliance with the credit repayment rules, the user is asked to take the credit limit and repay it monthly to improve the rating.

Taking into account how many people use banking services, the indicator is impressive. However, we should analyze even such a serious market participant. In the end, we will conclude whether “Equifax” is a scam, or does it maintain a high bar of quality of the provided services. Let’s begin.

Main Pros and Cons

Equifax, the simple and convenient service of checking and improving the credit history, allows not only to study information about your interaction with financial institutions, but also to correct them in case of mistake.

The product has pros and cons, so let’s review them.

Pros:

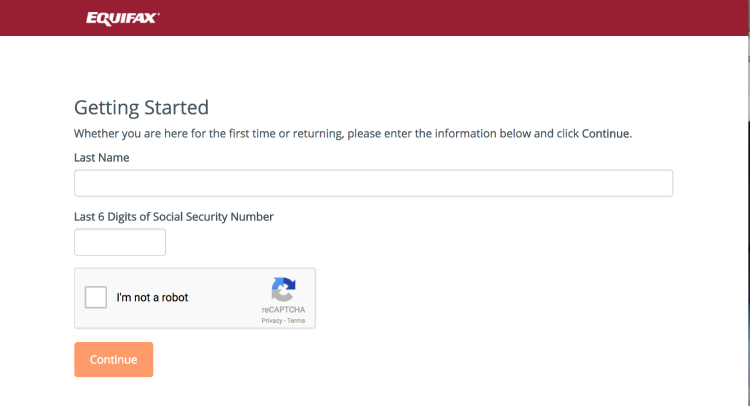

- Fast and simple registration. You only need to fill in a simple questionnaire (however, it will be necessary to confirm your identity for security purposes).

- High level of data security.

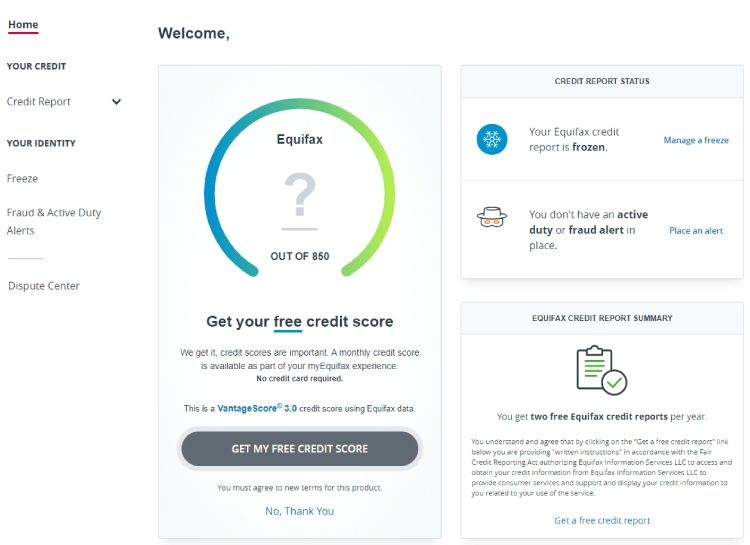

- Availability of free products. In principle, you may not invest in Equifax at all if you do not observe the dynamics of your credit history regularly, but simply wish to assess your chances of success in obtaining a loan.

- Promotions and gifts, generous loyalty program.

- Relatively low cost of services.

Cons:

- There’s no one score. Credit scores can vary by up to 50 points considering the type of loan you’re applying for — car, home, or personal. It means that potential creditors might not see the score you pay for.

- No FICO score. Equifax can give you an idea of what a potential creditor might see when you apply for credit. Still, most creditors rely on your FICO Score, which is not provided by Equifax.

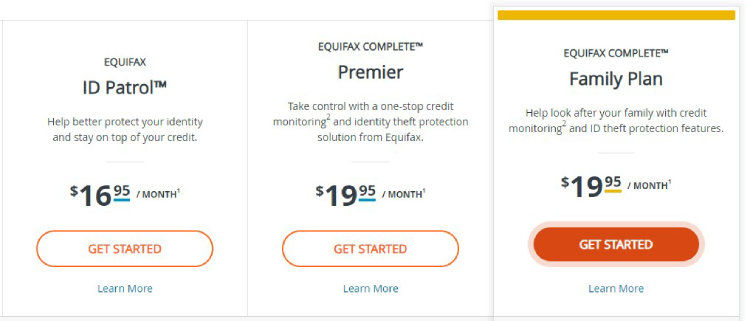

Equifax ID Patrol Pricing and Plans

- Equifax ID Patrol: For $16.95/month, you will protect your identity and keep an eye of your credit. It helps to monitor possible ID thefts with the help of 3-bureau credit monitoring. It also includes dark web scanning and alerts.

- Equifax Complete: For $19.95/month, you will receive alerts when your credit report or scores change. The plan also includes credit report monitoring from all three bureaus once a year, daily access to your Equifax credit score and report, credit report locks, automatic fraud alerts, unlimited accounts for financial alerts, internet scanning, ID theft assistance. With Equifax Complete, you’ll get $1 million in ID theft insurance for each adult, and 24/7 lost wallet protection.

- Equifax Complete Family Plan: For $29.95/month, you can cover two adults and four children in the same household. You will receive alerts when your credit report or scores change, credit report monitoring from all three bureaus once a year, daily access to your Equifax credit score and report, credit report locks for two adults, automatic fraud alerts, unlimited accounts for financial alerts, internet scanning, ID theft assistance, $1 million in ID theft insurance, and 24/7 lost wallet protection.

- Equifax Complete Report: For $39.95, you acquire your credit report and score from all three bureaus.

- Equifax Credit Report and Score: For $15.95, you can purchase your Equifax credit score and report.

- Credit Score Watch: For $14.95/month, you can monitor your FICO® score.

- Score Power: For $19.95, you receive a personalized score explanation and simulator.

Main Features and Services

The need to improve credit history may arise for various reasons. Sometimes false information about delays due to failures in the banking system is entered into the database. However, in most cases, it is the credit users themselves who failed to meet the due dates of the monthly payment or stopped paying the debt at all. In such a case, difficulties may arise in obtaining the next loan.

Equifax includes many useful features. You can also request a full credit report, which will reflect all requests to banking institutions and their responses, as well as the progress of repayment (including delays). Twice a year, you will get an electronic document for free. Here is the broader list of features.

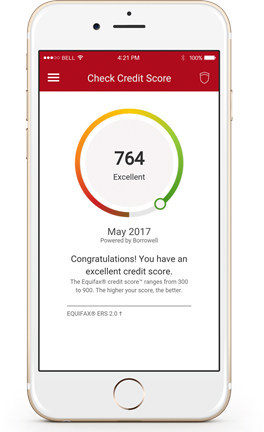

Equifax Credit Monitoring

Credit monitoring is necessary for expressing your creditworthiness. Each credit report includes scoring. For many years, the scoring (borrower rating) has been used by most banks to speed up the decision-making process on lending. This score is formed as a result of checking a person according to a certain list of rules related to your credit history (number of loans taken, amount of loans, availability of overdue payments on loans, number of overdue days, etc.). Each bank has its own individual list of rules depending on which parameters the bank considers more important than others.

The credit monitoring by Equifax will help to test yourself according to the universal model of scoring calculation, very close to the rules of most large banks. After the calculations according to the Equifax model, as a result, youll get a number-estimate, the value of which is in the range from 1 to 999. This is your personal scoring. The better the credit history, the higher the score. So, the bank will consider you a reliable credit user.

Having received the individual scoring, you will be able to:

- Learn how Equifax (and most banks are likely to) assess your creditworthiness.

- Assess the chances of obtaining a loan before applying to the bank.

- Follow the change of your scoring score depending on the improvement or deterioration of your credit history (delay, early repayment, other factors).

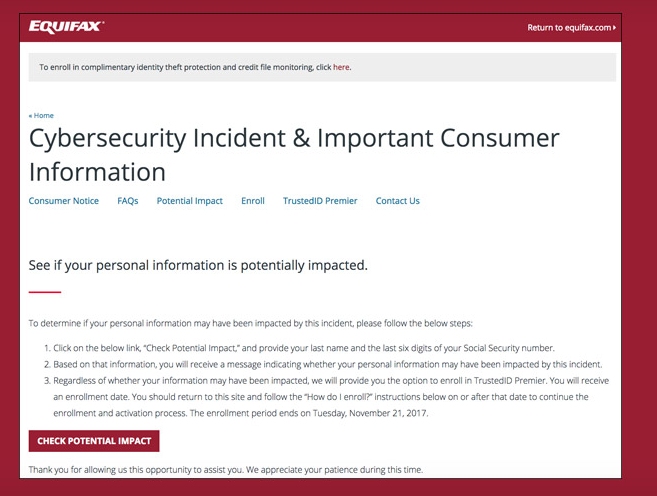

Equifax Fraud Alert

Credit fraud is today one of the most relevant and discussed topics on the internet. Forums are full of messages about how the shop employees issue a loan for the purchase of household appliances on copies of documents. Also, they report about 2-3 small loans are issued in 50% of cases on lost or stolen documents. And these are not the only possible situations when you can become the victim of fraud.

Equifax tracks new loans that could be issued in your name within a month of the purchase of the product and throughout the life of the product. You may not respond to this alert if you are the initiator of the loan. A new credit alert in your credit history will come via email and text messages. The message sent contains the name of the bank that issued the loan and the date of the loan.

How quickly you react by finding someone else’s credit depends on the outcome of the incident. On hot traces, the bank will be able to solve the crime faster by getting videos and documents from the crime scene.

Equifax Replacement Services

Often credit users, having successfully paid off the loan, are sure that now they have a good credit history. However, they can be surprised when, after applying for a new loan, they are denied and told that there is a debt in the credit history.

Even though Equifax is very careful about the data, the credit institution is responsible for transferring data into the credit history. Equifax can only find out that the data provided by the bank is not true from you. Errors in credit history are more of an exception to the rules. However, it is much worse to learn about the error at the time of the need to obtain a loan than to identify the error in advance and correct this information.

That is why timely control of your credit history guarantees you peace of mind and no surprises when getting credit. Equifax recommends you to receive at least one credit report a year to ensure your data is not compromised. If you have fully repaid the loan, Equifax recommends you to review your credit history after 1 month to make sure that the loan is indeed closed.

Equifax will carry out the following works:

- Check the correctness of the data transmitted by the source of generation of the corresponding record in the credit report;

- Contact the credit institution for further verification and subsequent validation of the information.

You can be sure that Equifax tries to do its best to verify the information as quickly as possible. However, the credit institution has 14 days under the law to check information with which the subject of the credit history does not agree. And in individual cases, it will not be possible to adjust earlier than the deadline.

Based on the results of the review, Equifax will send you an official response on behalf of the bureau, including explanations and additional information received as a result of the review. If the error is confirmed and the generation source changes accordingly, you will be provided with an additional credit report.

Equifax Credit Reports

Credit Report is a document that reflects your credit history, that is, summary information on your loans and their current status transmitted by credit institutions cooperating with Equifax.

Creditors, when deciding on issuing new loans or the establishment of a credit card limit, apply to Equifax for these reports to assess creditworthiness and integrity in the performance of credit obligations of a potential borrower. They carry fewer risks by lending to borrowers with a good credit history, and they are more loyal to them.

Equifax provides the first one-time credit report (after registration and identity confirmation) for free. The credit report is provided in the form of an electronic document in PDF format, signed by the analog of the hand signature of the general director of Equifax.

This report will help you to:

- Trace criminals and swindlers (with a credit report, you will be sure that no one has used your documents to obtain credit, or will be able to identify fraud);

- Understand the reason for credit denial (after receiving your credit report, you will be able to see what information about you is available to the creditor for decision-making, as well as the reasons for refusal to the bank);

- Correct unreliable information (if your credit history has errors, you can notify Equifax, and the bureau will make a request to the creditor for clarification and correction of the data).

Equifax Mobile Apps

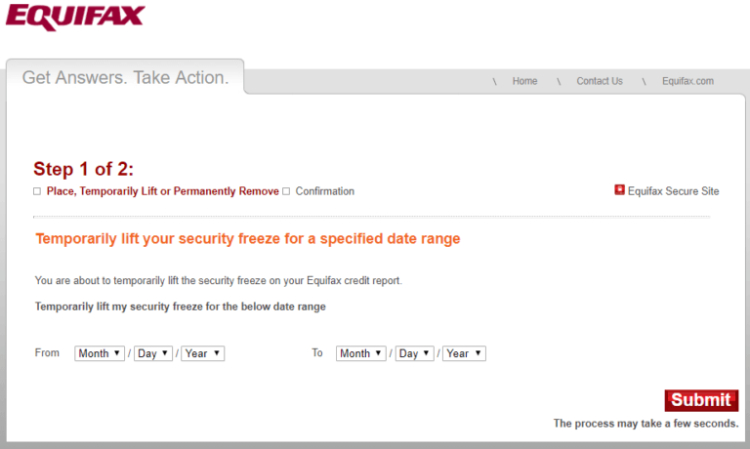

Equifax has a mobile app for Android and iOS, which is quite convenient, yet, it needs some interface enhancements. The key features of Equifax mobile app is:

- Equifax Places (free to use, no Equifax membership is necessary);

- Credit Rankings (credit averages such as total debt, utilization, and late payments);

- Fraud Index (frequency of fraud by demographic indicators, income, and credit score);

- Credit Report Control – (ability to manage your Equifax Credit Report);

- Equifax Web Detect – (find out if your sensitive information was compromised on suspected Internet trading sites);

- Alerts of key changes to your Equifax, Experian or TransUnion credit files (e.g. account balance increase/decrease, activity on dormant accounts, new account openings).

Customer Support

Equifax offers many ways to get help; everything depends on the product you’re asking about. If you have any questions or even concerns, you can contact Equifax Customer Support.

- Through the MyEquifax form – if you don’t want to overpay for a call, leave an application, and you’ll be called back.

- Phone. For general customer service, call 1-888-548-7878. A customer service representative should be able to direct your call to the appropriate department.

- Live chat. Customer care is available online weekdays from 8 a.m. to midnight.

- It is not always necessary to communicate with specialists. The most common situations and instructions are provided on the Help page of the site (main menu section).

Final Verdict

Even though banks are paying more and more attention to security issues and prevention of internal and external fraud, the attackers are not standing still either. They pass various bank checks and commit crimes. Of course, the main way to combat fraud is to be careful, but none of us is immune from compromising personal data or stealing passports and driving licenses. Sometimes frauds can be even where you don’t expect them.

Consequently, you can apply to such services as Equifax to keep an eye on your credit history, credit score, and possible ID thefts. It will notify you if your data is compromised in Dark Web and help to protect your children, if you have any.