What is ProtectMyID?

ProtectMyID is the service designed and provided by Experian, the multinational consumer credit reporting company. At the same time, Experian offers its customers a set of services that helps to prevent any form of identity theft and cybercrime. ProtectMyID doesn’t require any advanced knowledge in IT security or software design, and you can easily use the services and get access to all information.

Although you may use antivirus solutions and additional layers of security on your computer, it may not be enough to protect your credentials and data from cybercriminals. While your data is safe from cyber attack attempts with AV solutions, you never know whether third parties compromise your credentials. Unfortunately, often our data can be found on a black market and exposed to cybercriminals.

In this case, you have to have not only the shield from these brut attempts to use your identity and your credentials but to have proof that these actions were made without your consent. ProtectMyID uses an advanced scan and monitoring of your information that might appear suspicious. In essence, it is a crucial service for anyone who deals with any financial operations.

Overall, ProtectMyID is a system of alerts and monitoring that can be handy for you and prevent an unwanted and harmful data breach.

Pros and Cons

Pros

- Instant alerts via email or SMS – without any delays you are updated the moment the situation is changing.

- High-quality scan for data breaches and other information – ProtectMyID provides you with precise information about the potential data breach.

- Child identity theft protection – reduces the possibility of cybercriminals to use your child SSN for fraud.

- The address change can be monitored – any suspicious changes will be alerted.

- Provides educational materials – Experian offers you quite several articles and tips on the internet and information safety.

Cons

- Limits on the number of cards to monitor.

- Mixed reviews from customers about the service overall.

Main Features

Additional features like Identity Theft Monitor & Alerts and Child Identity Protection are the must-have in the meantime when dozens of thousands of identity theft cases happen every day. The personal assistance and guidance of highly qualified specialists is also a big advantage.

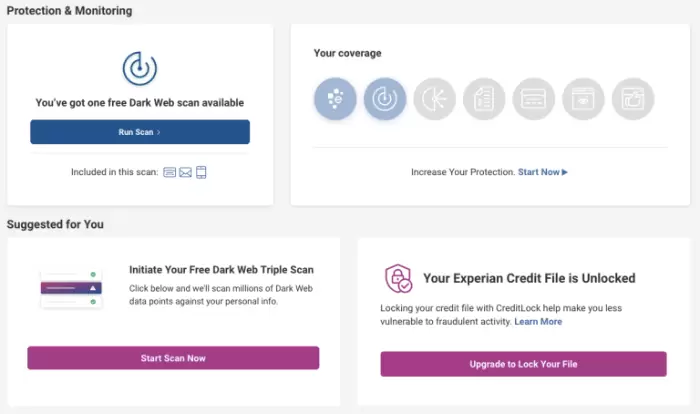

Dark Web Surveillance

You may know what dark web is, but as a quick reminder – dark web or darknet websites are hidden from indexed web search engines and can be accessed by using specific software and networks. These websites are not tracking location or IP of visitors, and users have no information about hosting. It creates the possibility for users to share files with high encryption.

It is the last place you want to find the information about yourself. Often darknet is the place where the information about users, their social numbers, or other credentials can be sold or exchanged. Due to the fact that darknet is hard to manage, these crimes can remain unsolved.

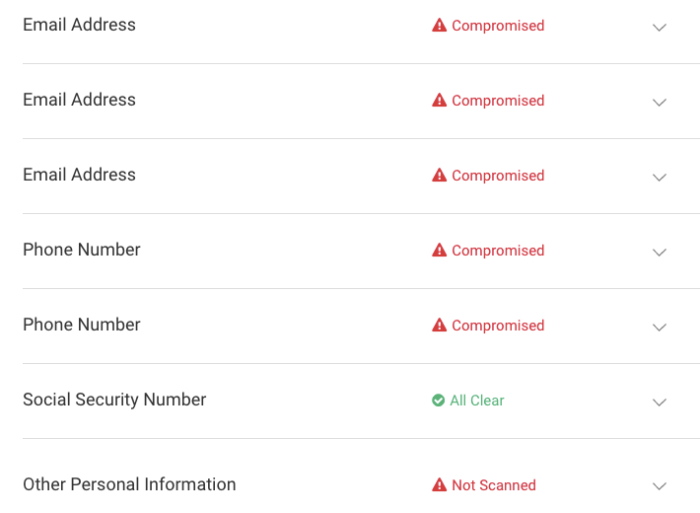

With an Experian ProtectMyID account, you can initiate a dark web scan of the bulk of encrypted data and see if your information is out there. ProtectMyID searches for SSN, emails, passport and medical IDs, bank account numbers, driver’s licenses, retail/membership, and credit/debit cards. That seems quite a lot of information.

How exactly and what resources ProtectMyID manages to scan? All you need is to set up your Experian account and find the Experian Dark Web Surveillance section, and you will receive alerts via email and your inbox. Your information will be searched at web pages, blogs, bulletin boards, peer-to-peer sharing networks, social media feed, web services, servers, and file transmissions.

Identity Theft Insurance

According to the Insurance Information Institute, usually identity theft insurance costs from $25 to $50 for a year. When using such services like ProtectMyID, these expenses are included in your chosen plan. Therefore, you are not paying any additional costs for this guarantee, in case if the crime has been committed and you are dealing with the restoration of your document.

For instance, if you have a Plus plan, you will have an ID theft insurance cover of up to $500,000. If having a Premium plan, you receive an ID theft insurance cover of up to $1 million.

Before agreeing to the terms and conditions of the offer, you have to review all limits and expenses coverage. For instance, long-distance phone calls, legal fees, child care costs, notary fees, lost wages, copies of your credit reports might be covered by the insurance. At the same time, The National Association of Insurance Commissioners suggests to research the following:

- what are the policy limits of the insurance;

- what fees are deductible;

- whether legal work is pre-approved by the insurer;

- what fees and limits are applied to the coverage.

On the other hand, when signing up the agreement for identity protection services, the insurance provider and the company might help you in the recovery process.

U.S.-Based Fraud Resolution Specialist

Although you might prevent the fraud case before it is too late, no service can guarantee one hundred percent prevention of identity theft. You may secure your data with additional tips. Still, if the situation has occurred, you can be sure that with ProtectMyID service, you can get help from the best professionals and feel less stressed.

Whether you are a US or UK resident, you can always count on the Experian Fraud Resolution Team. The Team is composed of highly trained professionals, who will assist you with the case, both credit and non-credit frauds.

The assigned specialist will contact credit grantors to dispute charges, close accounts, and provide all required additional assistance. In particular, specialists help you to investigate the case, dispute the fraudulent information with the lenders, discuss other security options like Cifas or a credit report password, and provide you with future report check-ins. The specialists will do their best to prove and confirm the fraudulent case, and you will get the instructions on the further steps you have to do.

You will be working with the specialist directly and keep in touch during all the process of recovery. If needed, you can also be assisted with all required further steps.

Lost Wallet Assistance

For at least once in a lifetime, we lose our waller or become a victim of a theft. Usually, we all bear in the wallet all our cards and ID or driver’s license, which may result in unfortunate consequences for ourselves. The count of time goes for minutes for those whose goal is to sell your information on the internet or take advantage of your credit cards.

Of course, the process of recovery and police reports is time-consuming. At the same time, considering that we all can forget what we have in our wallets, it becomes a real quest to provide an accurate description of what was lost. That’s when the Lost Wallet Assistance feature becomes an option that can save you time and money.

When having all essential information stored in a secured ProtectMyID dashboard, it will take a moment to do all necessary calls to your bank and provide specialists with all the required information. The convenience of Lost Wallet Assistance is obvious in comparison to the stressful and horrifying drive home to collect all documents you store on your shelf.

Additionally, you may receive the assistance of Experian specialists who will gladly help you out with the next steps.

Identity Theft Monitoring & Alerts

Identity theft monitoring and alerts are the essential features that come in your ProtectMyID service package. This feature helps you to prevent the corruption of your credentials if thieves obtain your information. You may want to use this feature before you notice something suspicious, for instance:

- your credit card was declined without providing reasoning;

- you see unexplained transactions or withdrawals from your bank account;

- get notification from a company that your account security has been breached;

- receive information from the IRS that is unfamiliar to you;

- you are sure your data might be corrupted.

You may place an identity theft monitoring and alert with ProtectMyID for 90 days. It will require the companies to double-check and verify credit requests without affecting your credit history overall. The process will take more time if you are the one who makes a credit request.

At the same time, you can place an extended fraud alert, but it will require filing a request form, and including copies of the identity theft report, you filled with law enforcement. The extended fraud alerts last for 7 years, which also demand from companies to remove you from their marketing lists for pre-screened credit offers (unless requested otherwise).

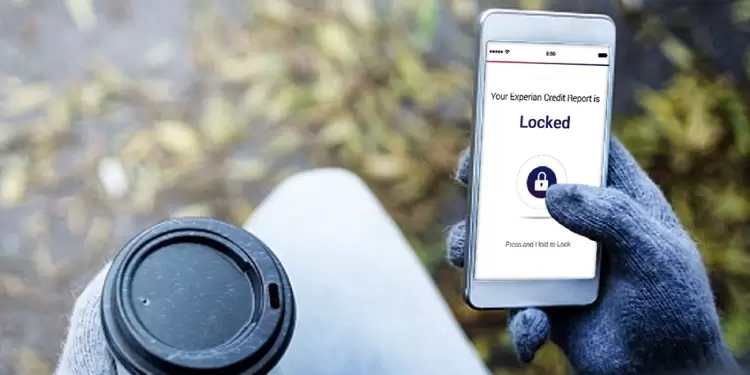

Experian CreditLock

This feature comes in your Experian subscription and doesn’t imply any additional cost. You can lock your Credit File within one click and prevent unauthorized credit activity with real-time alerts if someone tries to apply for credit with your credentials while the Credit File is locked.

Note that when you lock your Credit File, it is not accessible to banks and lenders that check your Credit File for a loan application or credit request, and companies that check your Credit File to open new apartment rentals, new utilities, or cellular services.

On the other hand, your Credit File is accessible for:

- your potential employers or insurance companies during the application process;

- companies providing pre-screened credit card offers, and you may choose to opt-out from the list;

- collection agencies acting on behalf of the companies you may owe;

- companies that have a credit relationship with you.

When using a feature of Credit Lock, you are ensuring that your Credit File will not be compromised by the fraudulent attempts to open credit with your credentials. You can always unlock your file if you are sure your data was not compromised, or you are in the market for credit or financing.

Credit Monitoring & Alerts

Credit monitoring & alerts consist of the company helping you to control your credit files. You will receive notification of every action that took place on your account for you to be aware of fraudulent attempts to open a credit in your name. The activity that might trigger these alerts include:

- new account openings – credit cards or loan;

- “hard” credit inquiries – when financial institutions run credit checks after credit card or loan requests are submitted;

- new public records – including but not limited to court judgments or bankruptcies information;

- address changes;

- accounts sent to collections – if there is a chance of unpaid debts.

With ProtectMyID you can customize notifications for avoiding overcrowding your inbox with updates and use a Credit Lock feature for the best protection of your Credit File.

At the same time, credit monitoring & alert feature do not cover such cases as:

- improving your credit history;

- fraud alerts and credit freezes;

- report fraud to the authorities;

- saves you from phishing emails.

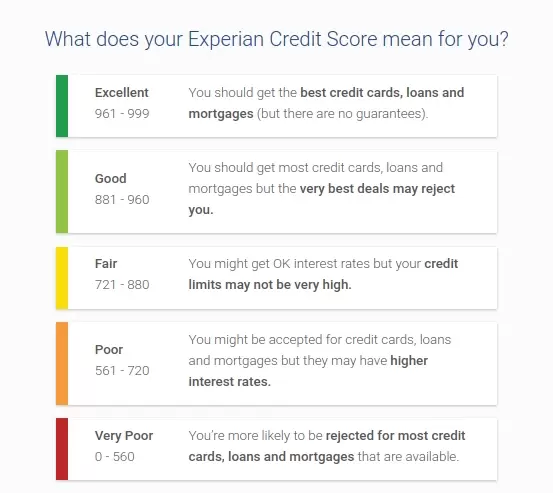

Credit Scores Monitoring

ProtectMyID offers you additional features of Credit Score monitoring when this activity is overwhelming. The best specialists and the system will assist you with the credit score report and managing your credit history.

This feature allows you to calculate your credit score from the information found in your credit report. You will also be able to see what factors are influencing the FICO score, including your payment history, amount of debt, credit history length, credit mix, and amount of new credit.

At the same time, Experian helps you to improve the quality of your Credit Score with the Experian Boost feature, with credit for utility bills and your phone, which will result in positive payments for your Experian Credit File without any additional fees. You also get a Credit Match tool to compare credit card rates, fees, and rewards to find a suitable card solution for you.

This feature is a convenient bonus for you, as you can easily understand your credit score history and see if your score needs improvements. The credit score is essential for banks, credit card companies, and car dealerships to approve your credit. When knowing where your score is, you can easily exclude denials or unfavorable terms of the deals.

Child Identity Protection

This feature allows you to prevent or identify if someone exploits your child’s social security number for fraudulent deals. You can easily access this feature when entering your Experian account and adding your child’s information. Then you can initiate a scan for their social security number breaches and view the report on the secured website.

At the same time, this feature allows you to freeze your child’s credit reports, which means that no new accounts will be created with their credentials, and no action can be taken on their behalf. It will not affect your child’s credit history in the future but reassure that their personal information is not compromised or breached. Credit freezes are similar to credit lock features, which prevents potential lenders from accessing your credit reports and disabling fraudsters to open new accounts in your name.

Moreover, having your child’s information exposed on the darknet or landers is tremendously dangerous and can result in unwanted consequences, from unexpected debt collection agencies’ requests to their overall security. Moreover, it is always good to be sure that our child is protected from the attention they don’t need at an early age.

Customer Service

ProtectMyID offers you a Monday – Friday 10 am – 3 pm support, which sounds not as exciting as it should be, but we must understand that some agencies and authorities also follow specific schedules.

You can contact the Team by the toll-free number indicated on their website or write an email. Customer service agents will help you with all your questions, from setting up your account to redirecting specific requests to relevant departments.

The support assistance is also set in a convenient manner, so you don’t have to contact the agent if you forgot your password – you can easily do it yourself. In other cases, rest assured that your question will be resolved as soon as possible, without unwanted delays or unclear solutions offered.

Package Comparison

IdentityWorks Plus Review

IdentityWorks Plus is considered to be a helpful hand in providing baseline protection for your data. This plan offers you all the essential features of ProtectMyID services, and it will cost you $9.99 per month. With IdentityWorks Plus, you also get an ID theft insurance cover of up to $500,000. However, this plan doesn’t include a credit score report. Plus Plan assists you with the help of U.S. based specialists.

IdentityWorks Premium Review

This plan is seen as advanced and most favorable if you want full control over your data. It will cost you $19.99 per month, and you become suitable for up to $1 million ID theft insurance. Additionally, IdentityWorks Premium offers you quarterly credit reports from all 3 bureaus partners, and you will get a variety of additional features missing from the basic Plus plan. These features include bank account & credit card alerts, identity validation alerts, payday loan monitoring, court records & bookings, sex offender registry, and social network monitoring.

Family Identity Protection

Family Identity Protection plan with 1 adult and up to 10 children.

- Plus: This plan offers you all basic features that allow you to monitor and receive alerts for your children and yourself for the price of $14.99 per month. There is no difference between the family Plus plan and the Individual Plus plan. You’ll get an ID theft insurance cover of up to $500,000 without a credit score report offered to you at the end of the month.

- Premium: You’ll be paying $24.99 per month for this plan, and you will get all the additional features of the Premium Individual plan. The insurance coverage limit is also up to $1million.

Family plan with 2 adults and up to 10 children.

- Plus: This plan is perfect for large families and comes with no additional fees, which will cost you $19.99 per month. Moreover, you have the guarantee on ID theft insurance cover of up to $500,000. Plus Plan also doesn’t provide you or your partner with a credit score report.

- Premium: It will cost $29.99 a month and provide you with an ID theft insurance cover of up to $1 million. The Premium plan offers you all extended features as other plans, without any additional fees for members. At the same time, you will get quarterly credit reports from all 3 partner bureaus. Moreover, it provides all surveillance and alerts features of the Individual Premium plan.

Final Verdict

ProtectMyID is quite an impressive service that allows you to gain control over your bills, information, and other aspects. Many features allow you to store your data securely without the fear of losing it or forgetting the essential questions if you lost your wallet or someone stole it. We consider Lost Wallet Protection to be one of the best tools to ensure our information integrity, even if such an unpleasant situation occurred to you.

The prices are also the least of your concern, as ProtectMyID from Experian provides you with top-notch service for an adequate price on the market. It doesn’t charge you any additional fees for using extended features and allows you to decide which tools you want to use.