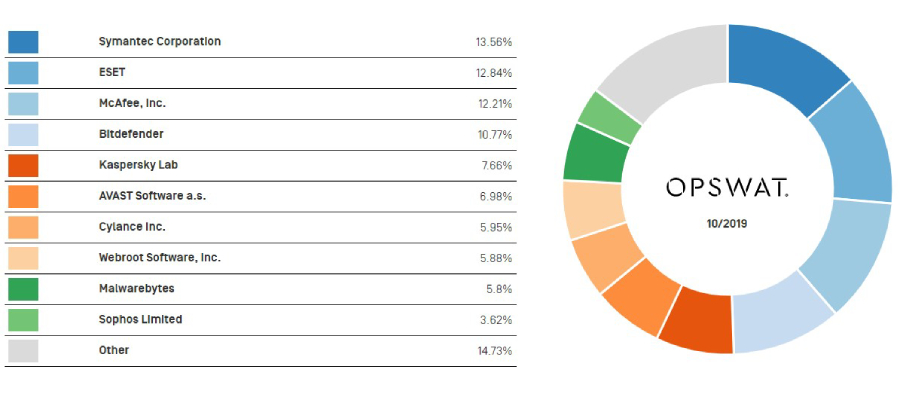

In the most recent report, OPSWAT shared a list of the leading antimalware software and vendors. This company is known for collecting data and sharing it with the public. They’ve been doing it for more than five years. According to the October 2019 report, Symantec and ESET are the leaders of the race, while McAfee is the close third.

The list of the most popular and far-reaching products/vendors consists of ten names, with the 11th called “Other” and representing the rest of the competition. In this post, we’ll take a closer look at every single one and talk about their respective market shares, as well as revenue in 2019. But before we do that, let’s familiarize ourselves with how OPSWAT comes up with these reports and why certain products weren’t included.

A Report On Windows Anti-Malware Solution (Without Windows Defender)

Since the Windows Defender is the default antivirus in Microsoft’s operating system, OPSWAT never includes it in the report. Besides, this isn’t a commercial product (there are no paid editions – never have been). That also explains why there’s no data on this software’s revenue.

As for the analysis and report, while it’s understandable that these aren’t 100% accurate numbers, they’re pretty much the only ones we get. OPSWAT officials also admit that this data can (and does) vary from the real situation on the market. It’s clear, however, that the top-3 are the obvious leaders, while the rest of the bunch has a lower market share.

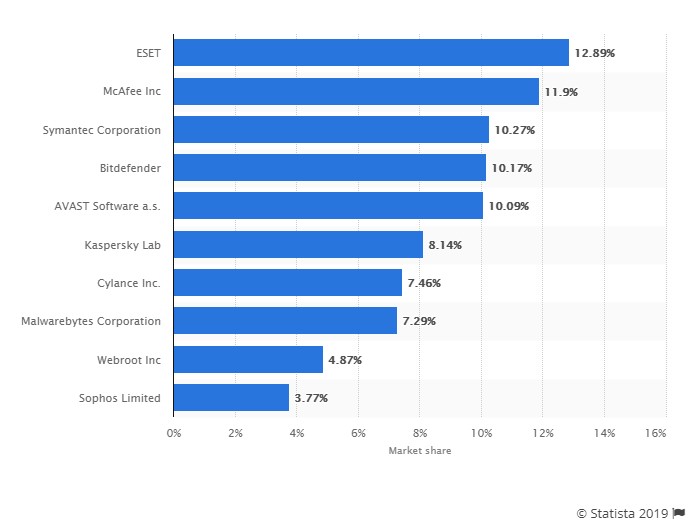

They’re still all pretty close to each other compared to what’s going on in other tech industries. But, as you’ll learn soon, some of the key players had big falls this year, while others saw an increase in market share. It’s also important to note that OPSWAT focuses on antimalware solutions rather than regular antivirus engines. Antimalware protects against spyware, keyloggers, adware, ransomware, and other threats along with more “traditional” viruses.

Windows Antivirus Market Share and Revenue Report – Top 5 Vendors

- Symantec. Thanks to a large market share of 13.56%, Symantec is the top antimalware company of the year. Based in Mountain View (California), Symantec has been in the business for almost 40 years (since 1982). The average annual revenue is 4.7/4.8 billion US dollars, and this year is no exception. In the 4th quarter of 2019, this tech giant repurchased 11+ million shares and retired 600 million dollars in debt.

It offers a wide range of cybersecurity services, including endpoint security, advanced threat protection, cloud security, and more.

- ESET. With 12.84% of the total antimalware share, ESET is falling less than one percent behind the #1 spot. That is a Slovakian security company with more than three decades of experience (founded in 1987). The estimated revenue in 2019 is ~580 million US dollars. True, compared to Symantec, it’s not nearly as impressive. However, this is still a great result, and it’s been relatively steady for the last five years or so.

- McAfee, Inc. Here, we have another big tech company that specializes in antimalware protection for home users, businesses, and enterprises. Server and email protection, industry-leading firewalls, and spyware removal tools are one of this company’s strongest suits. It holds 12.21% of the total market share and is pretty much on par with ESET.

The annual revenue is more than 2.1 billion dollars, and, just like the previous vendor, McAfee was established in 1987. But, as you can see, income doesn’t always mean a bigger share of the market.

- Bitdefender. Next on the list is one of the highest-ranked antivirus products. Again, while Bitdefender is only #4, that doesn’t change the fact that it is a leading antivirus solution, along with Kaspersky and Norton. And, a 10.77% share is still a good enough result. According to official statistics, 500+ million systems in 150+ countries around the world trust it with their protection.

Founded in 2001, this Bucharest-based vendor has been on the rise since the very beginning. And with such a strong fan base, they’re only about to get bigger. The annual revenue is ~140 million US dollars – that’s the lowest number on the list by far. But Bitdefender is more of a home-oriented antivirus provider, which explains the relatively lower income.

- Kaspersky. Despite the “rough patch” that it’s going through, Kaspersky is a big player in the industry in 2019. The 7.66% market share allowed this tech giant to make it into the top-5 of the most influential brands on the list. Last year, they delivered stable growth (up 4%) and earned 726 million dollars. This year, they’re only a couple of millions shy of that result.

If not for the geopolitical pressure, the Russian tech vendor could’ve possibly achieved even more impressive results. After Symantec and ESET, it is $700+ million is the highest result so far. In 2018, Kaspersky had a 16% growth in the so-called “enterprise segment,” and it continues to grow. At the same time, the North-American sales dropped by more than 25%, and this trend isn’t likely to go away any time soon.

Moving Down The List: 5-10 Market Share Holders

- Avast. The self-proclaimed “most user-friendly antivirus” is on top of the lower half of the list. It is, indeed, an intuitive, straightforward, and all-around decent antivirus. However, when compared to 2014, this year’s results aren’t at all impressive. Back then, Avast had 13.2% of the market share; in late 2015, that number grew to 15%.

By mid-2017, mainly thanks to the deal with AVG (Avast bought one of its biggest rivals), the market share reached 20.48%. For unknown reasons, the company (or, rather, the product) saw a decline in popularity, and by the end of 2018, the share had dropped to 17.42%. Twelve months later, in December 2019, we see only 7 percent (6.98%).

- Cylance Inc. This company is a clear example that while the top-5 is relatively “unshakable,” there’s still room for new players in the industry. With almost 6 percent of the total market share (5.95% is the exact number), it debuted on the list in early 2019. The vendor uses an AI-driven method of detecting and eliminating outside threats.

They’ve been experimenting with this technology for a while now. And, it seems like the international businesses/enterprises are starting to trust them with their security. Cylance made $240 million last year, and the 2019 revenue is almost exactly the same. On today’s list, it’s the youngest company, as it was founded in 2012.

- Webroot Software, Inc. It’s important to say right from the start that in early 2019, Webroot was acquired by Carbonite, Inc. That gave the staff more resources and time to perfect their original product. Last year, they had 218 million dollars in revenue; this year, the estimated number is even higher. Founded in 1997, they’ve been providing endpoint protection for more than two decades.

Today, Webroot has a market share of 5.88% (almost on par with Cylance). Interesting fact: in early/mid-2019, it was a lot less popular and only had an average share of 2%. In late 2018, the situation was significantly better (5.58%). This shouldn’t come to you as a surprise, though, as cloud-based protection isn’t always popular among enterprises.

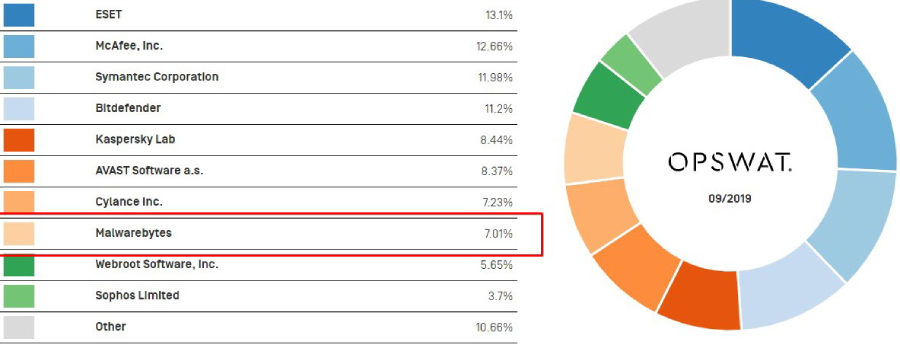

- Malwarebytes. As an alternative to the “classic” antivirus products, Malwarebytes focuses on detecting zero-day threats. Plus, it can be used with the likes of McAfee, Kaspersky, and other traditional solutions. This unusual approach earned it the 9th spot on the list, with 5.8% of the market. For comparison, in September 2019, this tech vendor was on the 8th spot, higher than Webroot, and almost on par with Cylance (7.23% at that moment).

In June, it was #5, with a market share of 8.07% (more than Kasperksy, by the way). The estimated annual revenue is $126 million – quite impressive for a company that’s been active “only” for ten years.

- Sophos Limited. At the very bottom of the list, we have Sophos with 3.62% of the total market share of antimalware products. On the financial side, they’re doing better than most brands on this list, though. In 2019, Sophos had a revenue growth of 12% and reached 710 million dollars by the end of November.

The Premium package is this software’s biggest selling point when it comes to home products. It’s available for cheap and protects up to ten devices. The business products are also up to date and offer some interesting perspectives to potential clients.

Summing Up

Last, but not least, we’ve got the “Other” antimalware solutions that take up ~15% of the market share. Those include Norton, TotalAV, Avira, Zemana, and other leading products. As mentioned in the beginning, market share doesn’t necessarily mean better protection. This list allows you to have a perspective and to learn about various vendors and their standings on the global market.

ESET isn’t as reliable as Kaspersky, Bitdefender, and McAfee, but it is higher up the list. If you want to check out the most reliable antivirus/antimalware software, go to the “Review” section on our website and take a look at our detailed reviews. And don’t forget to use the “Compare” option to put two solutions next to each other and, well, compare them.